District Intersects 29.2 m at 7.4% ZnEq or 2.9% CuEq on the Tomtebo Property

July 29, 2024 – District Metals Corp. (TSX-V: DMX) (OTCQB: DMXCF) (FRA: DFPP); (“District” or the “Company”) is pleased to report on assay results for the six drill holes (extension of TOM22-037B, TOM24-039 to -043) from the Spring 2024 drill program at the high grade polymetallic Tomtebo Property located in the Bergslagen Mining District in south-central Sweden.

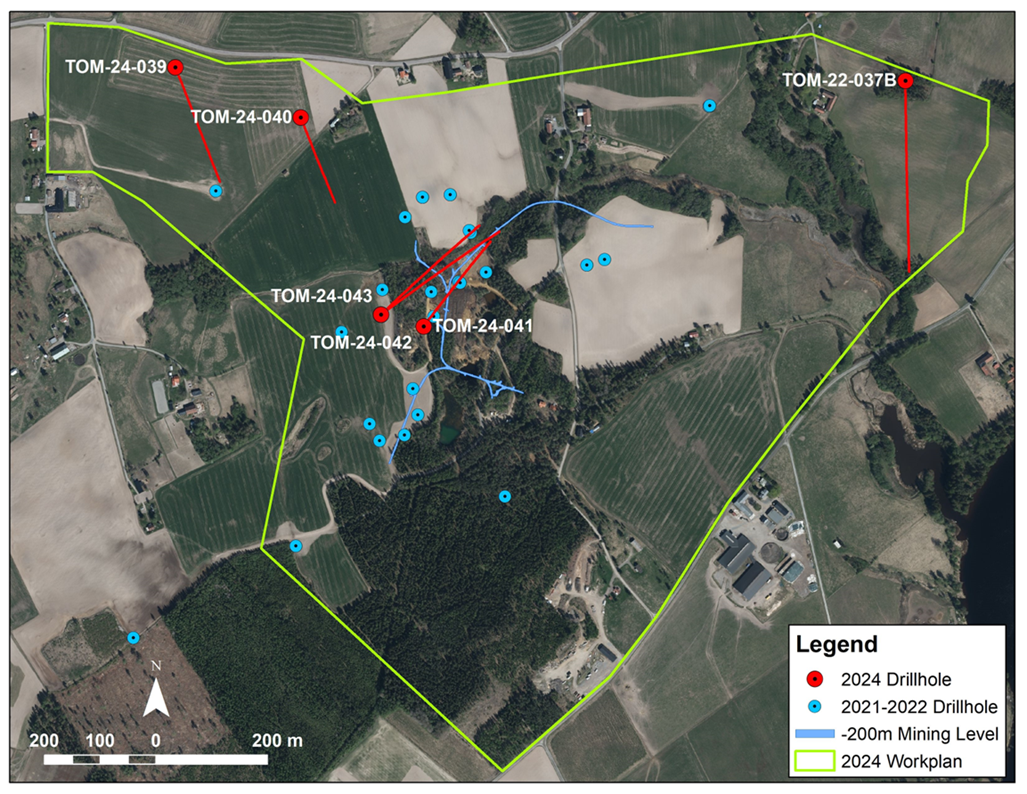

A total of 2,196 m in six drill holes was completed during this drill program that was carried out from mid-February to mid-April 2024 as part of the collaboration with Boliden Mineral AB. Strong footwall copper-rich polymetallic sulphide mineralization has been encountered at the Steffenburgs zone of the historic Tomtebo Mine (April 29, 2024 news release).

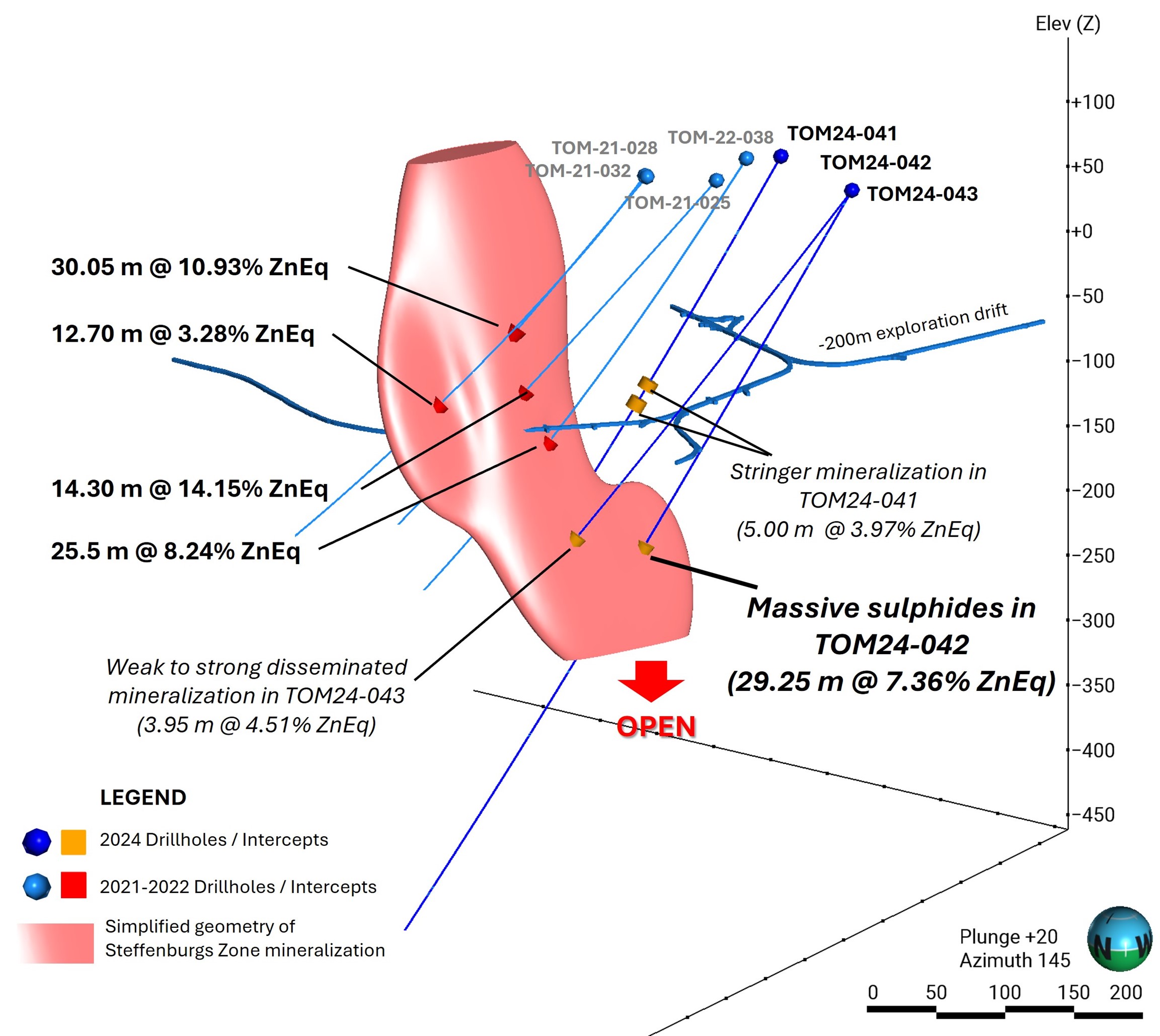

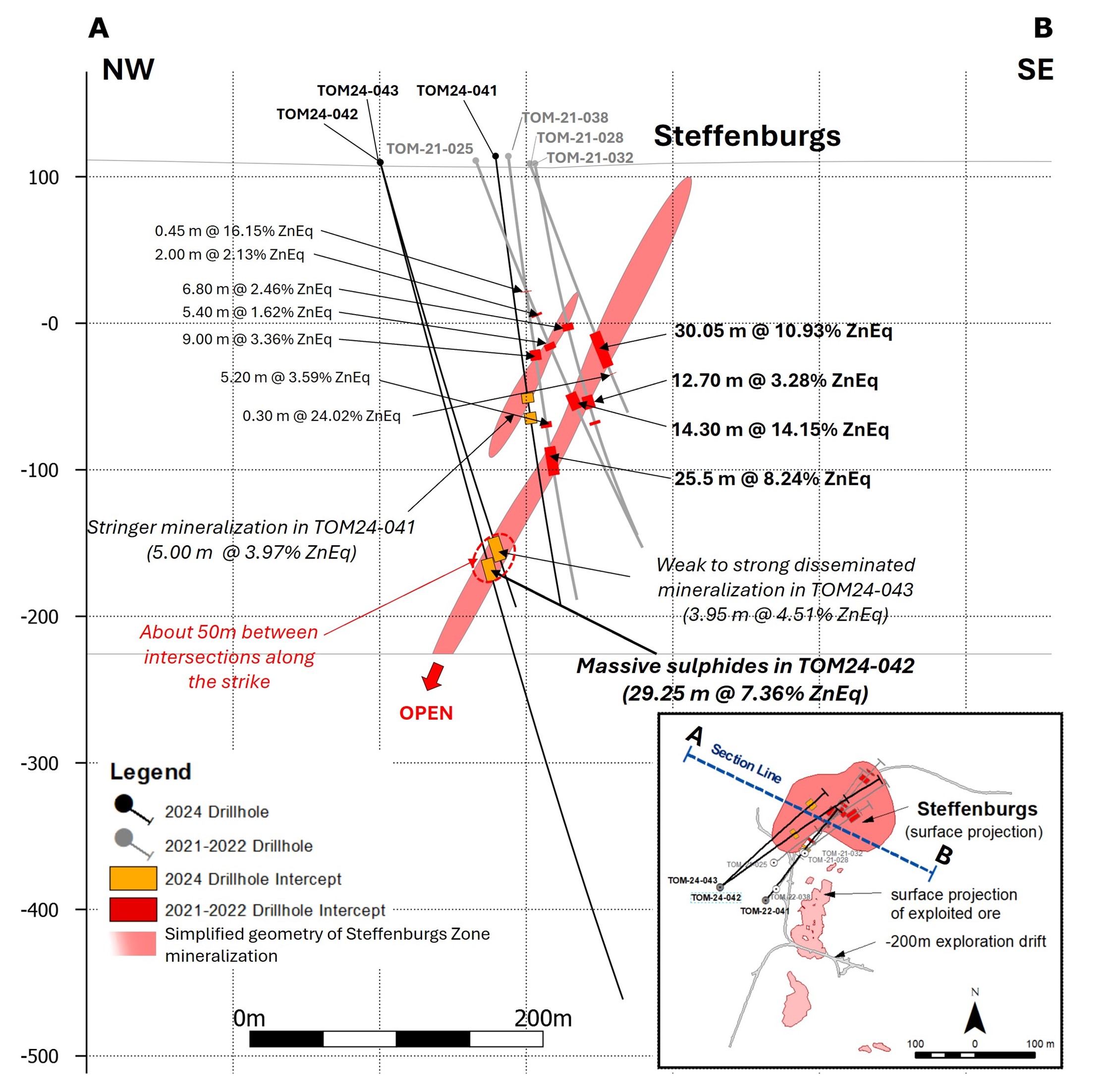

Drill holes TOM24-041 to -043 targeted the Steffenburgs zone massive sulphide lens down-dip beneath holes TOM21-025, -028 and TOM22-038, which were highlighted by down hole intercepts of 14.3 m at 14.2% ZnEq1 (210.0 to 224.3 m), 30.05 m at 10.9% ZnEq1 (148.35 to 178.40 m), and 25.5 m at 8.2% ZnEq1 (249.0 to 274.1 m), respectively. TOM24-042 was drilled 105 m down-plunge from TOM22-038 where mineralization remains wide open at depth.

Highlights:

- TOM24-042 intersected 29.25 m at 7.4% ZnEq1 or 2.9 CuEq2 (299.0 to 328.25 m)

- including 19.75 m at 10.0% ZnEq1 or 4.0% CuEq2 (306.0 to 325.75 m)

- including 13.0 m at 11.8% ZnEq1 or 4.7% CuEq2 (309.0 to 322.0 m)

- including 2.0 m at 16.1% ZnEq1 or 6.4% CuEq2 (309.0 to 311.0 m)

- TOM24-041 intersected 6.8 m at 3.3% ZnEq1 or 1.3% CuEq2 (191.0 to 197.8 m)

- including 5.0 m at 4.0% ZnEq1 or 1.6% CuEq2 (192.0 to 197.0 m)

- TOM24-043 intersected 3.95 m at 4.5% ZnEq1 (327.15 to 331.10 m)

- including 1.65 m at 9.0% ZnEq1 (327.15 to 328.80 m)

A drill hole plan and cross sections are shown in Figures 1 to 3, and drill assay results are shown in Table 1. Although holes TOM24-041 and -042 are copper-rich polymetallic intervals, the zinc equivalent grades are used in the cross sections to better illustrate the grade distribution within the Steffenburgs zone. Drill hole summaries are reported here.

Garrett Ainsworth, CEO of District, commented: “The drill assay results from hole TOM24-042 at the Steffenburgs zone exceeded our expectations in terms of the copper and gold values, and have delivered a strong interval of 29.2 m at 2.9% copper equivalent that remains wide open at depth. We consider our first drill program at Tomtebo in collaboration with Boliden to be a great success, and we look forward to further review with our partner before planning the next phase of drilling at Tomtebo.

We continue to carry out geological mapping, prospecting, and rock sampling for whole rock analysis across the Tomtebo and Stollberg Properties with an objective of identifying regional drill targets that are coincident with existing geophysical (conductive and magnetic) anomalies of interest. Planning for a drill program at the Stollberg Property in Fall 2024 remains on track.”

The Tomtebo drill program was designed to test both geological ideas as well as step outs at depth from previously significant intercepts of polymetallic sulphide mineralization at the Steffenburgs zone at the historic Tomtebo Mine.

Hole TOM22-037B was drilled in 2022 at an angled orientation (-50° dip) to the south (180° azimuth) to 357.9 m. It was designed to test a blind magnetic high anomaly along the interpreted Volcanic Massive Sulphide (VMS) mineralized horizon located 900 m northeast along trend from the historic Tomtebo Mine. Interpretation of the lithogeochemical samples taken in 2022 indicated that the hole did not pass the mineralized horizon and warranted continuation. TOM22-037B was extended by 200 m to 557.75 m. Although no significant mineralization was intersected, it can be concluded that the drill hole did pass through the VMS target horizon.

Both TOM24-039 and -040 were significant step outs northwest from the historic Tomtebo Mine to test the interpreted VMS mineralized horizon towards the west. These drill holes all intersected moderate to strong hydrothermally altered felsic volcanic rocks, which indicates that they are still within the Tomtebo VMS mineralized system. However, no significant polymetallic sulphide mineralization was intersected, but whole rock geochemical results should determine the rock precursor and alteration intensity. This should determine if the drill holes passed the VMS target horizon.

Drill hole TOM24-041 to -043 targeted the Steffenburgs zone massive sulphide lens down-dip. All holes intersected intense proximal footwall-style alteration and associated footwall stringer sulphide veins and sulphide impregnation. In addition, TOM24-042 intersected extensive strong semi-massive to massive sulphide mineralization, earlier than expected and was observed to be copper-rich, which could be intense footwall VMS mineralization rather than the sea floor massive sulphide intersected in hole TOM21-001, -025 and -028. The structural complexity of the Steffenburgs zone makes it difficult to delineate the seafloor massive sulphides at the expected VMS mineralized horizon, and warrants systematic drilling in combination with down-hole electromagnetic plate modeling and whole rock geochemical interpretation work.

Figure 1: Plan Map of Drilling at Tomtebo

Figure 2: Simplified 3D model Looking Southeast at Steffenburgs Zone

Figure 3: Simplified Cross Section Looking Northeast at Steffenburgs Zone

Table 1: Tomtebo Drill Assay Results

| Drill Hole | Depths and Interval | Assay Results | |||||||||||

| Hole ID | Azimuth | Dip | Total Depth (m) | From (m) | To (m) | Interval (m) | Ag (g/t) | Zn (%) | Pb (%) | Au (g/t) | Cu (%) | ZnEq (%) | CuEq (%) |

| TOM22-037B | 180 | -50 | 557.75 | No significant results | |||||||||

| TOM24-039 | 159 | -50 | 326.90 | No significant results | |||||||||

| TOM24-040 | 158 | -50 | 263.80 | No significant results | |||||||||

| TOM24-041 | 37 | -59 | 362.80 | 91.40 | 92.00 | 0.60 | 4 | 0.02 | 0.01 | 0.03 | 0.51 | 1.51 | 0.60 |

| 99.00 | 99.60 | 0.60 | 5 | 0.07 | 0.02 | 0.06 | 0.43 | 1.47 | 0.58 | ||||

| 103.00 | 104.60 | 1.60 | 10 | 0.24 | 0.03 | 0.27 | 0.61 | 2.83 | 1.12 | ||||

| 115.85 | 116.50 | 0.65 | 5 | 0.08 | 0.01 | 0.21 | 0.20 | 1.30 | 0.51 | ||||

| 151.00 | 152.00 | 1.00 | 6 | 0.05 | 0.00 | 0.26 | 0.33 | 1.75 | 0.69 | ||||

| 175.00 | 176.00 | 1.00 | 5 | 0.29 | 0.01 | 1.04 | 0.23 | 3.97 | 1.57 | ||||

| 179.00 | 181.00 | 2.00 | 11 | 0.23 | 0.04 | 0.20 | 0.29 | 1.83 | 0.72 | ||||

| 191.00 | 197.80 | 6.80 | 13 | 0.11 | 0.03 | 0.34 | 0.75 | 3.34 | 1.32 | ||||

| incl. | 192.00 | 197.00 | 5.00 | 15 | 0.13 | 0.03 | 0.42 | 0.88 | 3.97 | 1.57 | |||

| 200.70 | 201.00 | 0.30 | 4 | 0.04 | 0.01 | 0.07 | 0.43 | 1.45 | 0.57 | ||||

| 209.00 | 214.50 | 5.50 | 10 | 0.09 | 0.06 | 0.13 | 0.38 | 1.71 | 0.68 | ||||

| 230.00 | 235.50 | 5.50 | 10 | 0.84 | 0.27 | 0.10 | 0.29 | 2.35 | 0.93 | ||||

| 240.40 | 241.80 | 1.40 | 10 | 0.49 | 0.20 | 0.10 | 0.16 | 1.62 | 0.64 | ||||

| 248.80 | 249.70 | 0.90 | 27 | 0.18 | 0.30 | 0.11 | 0.27 | 2.11 | 0.83 | ||||

| TOM24-042 | 54 | -61 | 657.00 | 53.85 | 55.35 | 1.50 | 3 | 1.56 | 0.03 | 0.03 | 0.17 | 2.18 | 0.86 |

| 261.00 | 263.00 | 2.00 | 19 | 0.94 | 0.67 | 0.07 | 0.01 | 2.24 | 0.89 | ||||

| 267.80 | 268.65 | 0.85 | 45 | 2.04 | 1.21 | 0.15 | 0.18 | 5.15 | 2.03 | ||||

| 291.30 | 294.00 | 2.70 | 14 | 1.44 | 1.10 | 0.07 | 0.03 | 3.05 | 1.21 | ||||

| 299.00 | 328.25 | 29.25 | 30 | 1.58 | 0.79 | 0.67 | 0.95 | 7.36 | 2.91 | ||||

| incl. | 306.00 | 325.75 | 19.75 | 41 | 2.05 | 1.06 | 0.95 | 1.29 | 10.01 | 3.96 | |||

| incl. | 309.00 | 322.00 | 13.00 | 48 | 2.50 | 1.48 | 1.10 | 1.44 | 11.79 | 4.66 | |||

| incl. | 315.00 | 321.00 | 6.00 | 46 | 1.76 | 0.41 | 1.75 | 1.59 | 12.31 | 4.87 | |||

| incl. | 309.00 | 311.00 | 2.00 | 63 | 6.13 | 6.50 | 0.22 | 0.79 | 16.12 | 6.37 | |||

| 332.00 | 334.00 | 2.00 | 16 | 1.19 | 0.56 | 0.06 | 0.03 | 2.33 | 0.92 | ||||

| TOM24-043 | 49 | -53 | 386.00 | 58.05 | 58.45 | 0.40 | 42 | 0.70 | 0.03 | 0.70 | 1.67 | 8.00 | 3.16 |

| 63.40 | 64.00 | 0.60 | 15 | 0.58 | 0.04 | 0.19 | 0.59 | 3.04 | 1.20 | ||||

| 68.05 | 69.25 | 1.20 | 8 | 0.15 | 0.00 | 0.19 | 0.31 | 1.69 | 0.67 | ||||

| 74.40 | 79.65 | 5.25 | 8 | 0.24 | 0.02 | 0.20 | 0.27 | 1.68 | 0.66 | ||||

| 327.15 | 331.10 | 3.95 | 21 | 1.85 | 1.54 | 0.22 | 0.06 | 4.51 | 1.78 | ||||

| incl. | 327.15 | 328.80 | 1.65 | 41 | 3.58 | 3.42 | 0.43 | 0.05 | 9.00 | 3.56 | |||

| 338.70 | 339.50 | 0.80 | 9 | 1.22 | 0.38 | 0.24 | 0.07 | 2.62 | 1.04 | ||||

| 350.20 | 356.95 | 6.75 | 3 | 1.33 | 0.52 | 0.02 | 0.01 | 1.97 | 0.78 | ||||

Notes:

- All intervals are core lengths, and true thicknesses are yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated.

- Cut-off grade of 1.3% ZnEq was utilized, which may include up to 2.0 m of internal dilution. Underground mining cut-off at the nearby Garpenberg Mine was US$46.60/tonne in 2023.

- Metal prices used in USD for the ZnEq cut-off calculations were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb.

- ZnEq = Zn% + (Ag g/t × 0.0257) + (Au g/t x 2.831) + (Cu% × 2.529) + (Pb% × 0.882)

- CuEq = Cu% + (Au g/t x 1.1192) + (Ag g/t × 0.0102) + (Zn% x 0.3953) + (Pb% x 0.3488)

- The use of ZnEq and CuEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

References

1 Metal prices used in USD for the ZnEq calculation were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb. ZnEq equals = Zn% + (Ag g/t × 0.0257) + (Au g/t x 2.831) + (Cu% × 2.529) + (Pb% × 0.882). The use of ZnEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

2 Metal prices used in USD for the CuEq cut-off calculation were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb. CuEq equals = Cu% + (Au g/t x 1.1192) + (Ag g/t × 0.0102) + (Zn % x 0.3953) + (Pb % x 0.3488). The use of CuEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

Technical Information

All scientific and technical information in this news release has been prepared by, or approved by Garrett Ainsworth, PGeo, President and CEO of the Company. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The drill core reported in this news release was logged and prepared at the District Metals AB core facility in Säter, Sweden before submittal to ALS Geochemistry in Malå, Sweden where the NQ-size drill core is cut, bagged, and prepared for analysis. Sample pulps were sent to ALS Geochemistry in Ireland (an accredited mineral analysis laboratory) for analysis. Samples were analyzed using a multi-element ultra trace method combining a four-acid digestion with ICP-MS analytical package (“ME-MS61”). Over limit sample values were re-assayed for: (1) values of copper >1%; (2) values of zinc >1%; (3) values of lead >1%; and (4) values of silver >100 g/t using the high-grade material ICP-AES analytical package (“ME-OG62”). When required, additional over limit sample values were re-assayed for: (1) values of zinc >30%; (2) values of lead >20% using the high precision analysis of base metal ores AAS analytical package (“Zn, Pb-AAORE”). Gold, platinum, and palladium were analyzed using the 30 g lead fire assay with ICP-AES finish analytical package (“PGM-ICP23”). Certified standards, blanks, and duplicates were inserted into the sample shipment to ensure integrity of the assay process. Selected samples were chosen for duplicate assay from the coarse reject and pulps of the original sample. No QA/QC issues were noted with the results reported.

Mr. Ainsworth has not verified any of the information regarding any of the properties or projects referred to herein other than District’s Properties. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on District’s Properties.

About District Metals Corp.

District Metals Corp. is led by industry professionals with a track record of success in the mining industry. The Company’s mandate is to seek out, explore, and develop prospective mineral properties through a disciplined science-based approach to create shareholder value and benefit other stakeholders.

District is a polymetallic exploration and development company focused on the Viken and Tomtebo Properties in Sweden. The Viken Property covers 100% of the uranium-vanadium Viken Deposit, which is an asset with substantial exploration and development expenditures that resulted in the definition of large historic polymetallic resource estimates in 2010 and 2014. The Viken Deposit is amongst the largest deposits by total historic mineral resources of uranium and vanadium in the world.

The advanced exploration stage Tomtebo Property is located in the Bergslagen Mining District of south-central Sweden and is situated between the historic Falun Mine and Boliden’s Garpenberg Mine that are located 25 km to the northwest and southeast, respectively. Two historic polymetallic mines and numerous polymetallic showings are located on the Tomtebo Property along an approximate 17 km trend that exhibits similar geology, structure, alteration and VMS/SedEx style mineralization as other significant mines within the district.

For further information on the Tomtebo Property, please see the technical report entitled “NI 43-101 Update Technical Report on the Tomtebo Project, Bergslagen Region of Sweden” dated effective October 15, 2020 and amended and restated on February 26, 2021, which is available on SEDAR+ at www.sedarplus.ca.

On Behalf of the Board of Directors

“Garrett Ainsworth”

President and Chief Executive Officer

(604) 288-4430

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking Information”

This news release contains certain statements that may be considered “forward-looking information” with respect to the Company within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved” and any similar expressions. In addition, any statements that refer to expectations, predictions, indications, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events. Forward-looking information in this news release relating to the Company include, among other things, statements relating to the Purchase Agreement and closing thereof; the Company’s Swedish polymetallic properties; the Company’s planned exploration activities, including its drill target strategy and next steps for the Swedish properties; and the Company’s interpretations and expectations about the results on the Swedish properties.

These statements and other forward-looking information are based on opinions, assumptions and estimates made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate and reasonable in the circumstances, as of the date of this news release, including, without limitation, assumptions about the reliability of historical data and the accuracy of publicly reported information regarding past and historic mines in the Bergslagen district; and in respect of the intention of the Swedish government to eventually lift or amend its moratorium on uranium exploration and mining in Sweden; the Company’s ability to raise sufficient capital to fund planned exploration activities, maintain corporate capacity; and stability in financial and capital markets.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to risks associated with the following: the reliability of historic data on District’s properties; the Company’s ability to raise sufficient capital to finance planned exploration; that the Swedish government maintains its moratorium on uranium exploration and mining in Sweden for the foreseeable future; the Company’s limited operating history; the Company’s negative operating cash flow and dependence on third-party financing; the uncertainty of additional funding; the uncertainties associated with early stage exploration activities including general economic, market and business conditions, the regulatory process, failure to obtain necessary permits and approvals, technical issues, potential delays, unexpected events and management’s capacity to execute and implement its future plans; the Company’s ability to identify any mineral resources and mineral reserves; the substantial expenditures required to establish mineral reserves through drilling and the estimation of mineral reserves or mineral resources; the uncertainty of estimates used to calculated mineralization figures; changes in governmental regulations; compliance with applicable laws and regulations; competition for future resource acquisitions and skilled industry personnel; reliance on key personnel; title matters; conflicts of interest; environmental laws and regulations and associated risks, including climate change legislation; land reclamation requirements; changes in government policies; volatility of the Company’s share price; the unlikelihood that shareholders will receive dividends from the Company; potential future acquisitions and joint ventures; infrastructure risks; fluctuations in demand for, and prices of metals; fluctuations in foreign currency exchange rates; legal proceedings and the enforceability of judgments; going concern risk; risks related to the Company’s information technology systems and cyber-security risks; and risk related to the outbreak of epidemics or pandemics or other health crises. For additional information regarding these risks, please see the Company’s Annual Information Form dated July 11, 2022, under the heading “Risk Factors”, which is available at www.sedarplus.ca. These factors and assumptions are not intended to represent a complete list of the factors and assumptions that could affect the Company. These factors and assumptions, however, should be considered carefully. Although the Company has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking information or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Also, many of such factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to publicly update or revise such forward-looking information, except as required by applicable securities laws.