Acquisition of Bakar High Grade Copper Property

May 2, 2019 - MK2 Ventures Ltd. (TSXV/NEX: MK.H; "MK2" or the “Company”) is pleased to announce that, after an extensive global search, including numerous comprehensive project reviews, it has entered into a definitive purchase agreement dated May 1, 2019 (the "Purchase Agreement") with Longford Capital Corp. (the "Vendor") to acquire a 100% ownership interest in the Bakar high grade copper property located on Northern Vancouver Island, British Columbia (the "Bakar Property").

The Bakar Property

Based on the geological setting (i.e. within the sub-aerial Karmutsen volcanic and sedimentary sequence), and the copper-silver mineralogy assemblages and styles, the Bakar Property is classified as a redbed copper-silver prospect. Redbed copper projects include the Keweenaw and Porcupine districts of Michigan, the Kennecott deposit in Alaska and the 47zone deposit in the Northwest Territories.

Highlights of the Bakar Property include the following:

- Seven chip samples from outcrop were recovered during a due diligence site visit in December 2018 with the highest assay returning 38.7% Cu and 221.0 g/t Ag (Table 1), associated with semi-massive copper sulphides and native copper.

- During the same site visit mineralization was observed intermittently over at least 30 m of apparent thickness in a N-NE trending near vertical fault zones as well as in flat lying replacement bodies. The mineralized trend strikes NW-SE for more than 200 m, and is open on both ends.

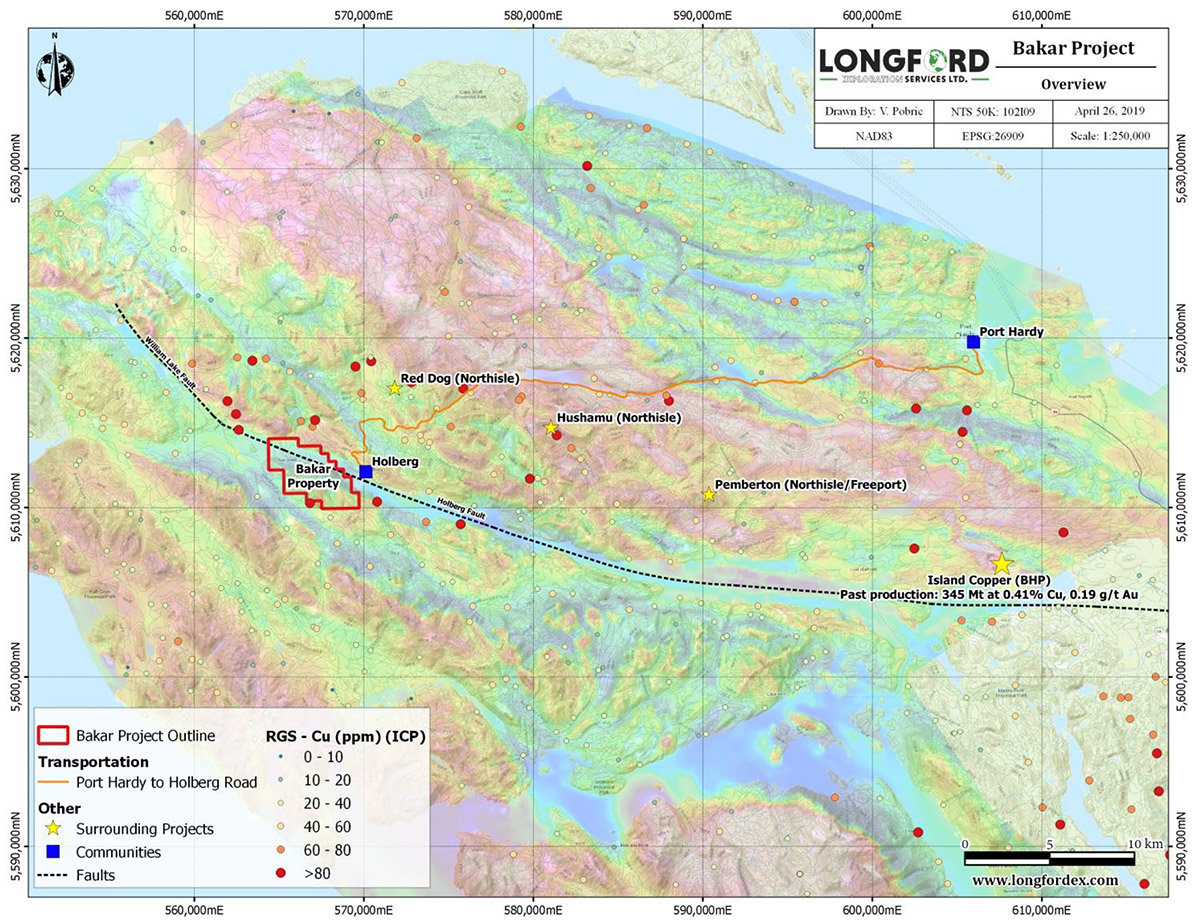

- The property covers an area of 1,349 ha and is located 2 km west from the active logging village of Holberg and 40 km west from the full-service town of Port Hardy (Figure 1).

- The property is located within a copper-rich geological domain that hosts the previously producing Island Copper Mine, the Hushamu Deposit, and the Red Dog Deposit.

- Prospective regional geological, geophysical and geochemical features include:

- a major structural suture that runs NW-SE through the property;

- magnetic high features adjacent to an extensive NW-SE magnetic low corridor

- copper in till anomalies that also trend NW-SE.

- No modern exploration has been carried out on the property.

The Company also believes the property and surrounding area has the potential to host polymetallic porphyry and skarn type deposits.

Garrett Ainsworth, CEO of MK2, commented: “Based on our geological, geochemical, and geophysical compilation work we believe that the Bakar Property has the potential to possess the grade and size required of a discovery of importance. An airborne VTEM survey, geological mapping, and stream sediment sampling will be conducted prior to a decision to drill test any priority one targets that are generated. No modern exploration work has been completed at Bakar, and we are keen to carry out this first phase of exploration on a budget that is well within the Company’s current cash resources.”

Galen McNamara, VP Exploration & Development of MK2, commented: “The Bakar Property represents an excellent new British Columbia high-grade prospect with the highest copper grades I’ve ever seen outcropping at surface. Additionally, the mineralization and geologic setting share striking similarities to the famous copper districts of Michigan’s Upper Peninsula. Combined with the fact that much of the area is generally unexplored, we are excited to begin a fully-funded exploration program almost immediately.”

The Purchase Agreement

Under the terms of the Purchase Agreement, MK2 will complete its purchase of a 100% interest in the Bakar Property in consideration of the following payments and share issuances to the Vendor:

- $10,000 cash deposit upon execution of the Purchase Agreement;

- $40,000 cash payment upon closing of the acquisition;

- 500,000 common shares of the Company upon closing with a statutory hold period expiring 4 months from the date of issue;

- 750,000 common shares of the Company upon closing with a statutory hold period expiring 6 months from the date of issue;

In addition, the Company will grant the Vendor a 2% NSR at closing of the acquisition subject to the right of the Company to repurchase 1% of the royalty for a $1,500,000 cash payment, and the remaining 1% for a $5,000,000 cash payment.

Finally, pursuant to the Purchase Agreement the Company must incur $200,000 in expenditures on the Bakar Property work commitments within six (6) months of closing of the acquisition, or the Bakar Property will be forfeited. However, the Company's immediate plans for the property will account for a material portion of this commitment. In addition, the Company has more than sufficient cash reserves to complete the balance of expenditure requirements, in due course.

Completion of the acquisition is subject to the approval of the TSX Venture Exchange (the "Exchange") which in turn shall be conditional upon, among other things, preparation and filing of technical report on the Bakar Property in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects ("NI 43-101").

No finder's fee is payable by the Company in connection with the proposed transaction and for the purposes of applicable Exchange policies, the Vendor is not a non-arm’s length party to the Company.

The acquisition of the Bakar Property by the Company is considered a Fundamental Acquisition by the Exchange and therefore trading in the common shares of the Company has been halted in accordance with the policies of the Exchange and will remain halted until such time as required documentation has been filed with and accepted by the Exchange and permission to resume trading has been obtained from the Exchange.

Technical Information

All scientific and technical information in this news release has been prepared by or reviewed and approved by Garrett Ainsworth, PGeo, President and CEO of the Company, and Galen McNamara, PGeo, Vice President Exploration and Development of the Company Each of Mr. Ainsworth and Mr. McNamara is a qualified person for the purposes of NI 43-101.

The chip samples from outcrop reported in this news release were recovered by Mr. Ainsworth and Mr. McNamara perpendicular to outcropping mineralization across widths of 0.5 to 1.0 m. A total of seven chip samples were then transported from the Bakar Property to Bureau Veritas Mineral Laboratories (BVML) in Vancouver, BC for preparation and analysis. Samples were analyzed for 45 elements with four acid digestion Inductivity Coupled Plasma – Mass Spectrometry (ICP-MS). Over limit sample values were re-assayed for copper values over 10.0% using copper assay by classical titration (GC820), and silver values over 200 g/t by four acid digestion Inductivity Coupled Plasma - Emission Spectroscopy (ICP-ES).

Mr. Ainsworth and Mr. McNamara have not verified any of the information regarding any of the properties or projects referred to herein other than the Bakar Property and mineralization at those other properties or projects is not necessarily indicative of mineralization on the Bakar Property.

Table 1: Bakar Outcrop Chip Sample Assay Results

| Sample Number | Easting (m) NAD83 | Northing (m) NAD83 | Cu (wt%) | Ag (g/t) | Sample Description |

| 3267001 | 566249 | 5611229 | 0.8 | 1.8 | Quartz carbonate veining within an altered tuff with prevalent malachite staining. |

| 3267002 | 565856 | 5611130 | 0.01 | <0.10 | Possible fault breccia of oxidized medium grained basalt with intensive limonite staining |

| 3267003 | 566799 | 5612393 | 0.01 | <0.10 | Intense shearing and extensive limonite alteration present in a fine-grained basalt with

highly oxidized sulphides. |

| 3267004 | 566620 | 5612443 | 38.7 | 221.0 | Strongly mineralized and oxidized sheared basalt with tarnished sulphides including bornite, chalcocite, chalcopyrite and native copper. |

| 3267005 | 566623 | 5612447 | 7.7 | 6.4 | Moderately mineralized and oxidized sheared basalt with tarnished sulphides including

bornite, chalcocite and malachite |

| 3267006 | 566627 | 5612451 | 34.3 | 37.7 | Strongly mineralized and oxidized sheared basalt with tarnished sulphides including bornite, chalcocite, chalcopyrite and malachite |

| 3267007 | 566620 | 5612443 | 10.3 | 65.7 | Moderately mineralized and oxidized sheared basalt with tarnished sulphides including bornite, chalcocite, chalcopyrite and native

copper. |

On Behalf of the Board of Directors ON BEHALF OF THE BOARD

“Garrett Ainsworth”

President and Chief Executive Officer 604-628-5616

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information.

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including completion of the acquisition of the Bakar Property and planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that regulatory approval to the Purchase Agreement will be obtained, that general business and economic conditions will not change in a material adverse manner and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward- looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward- looking information or statements, including, among others: that regulatory approval to the transactions contemplated by the Purchase Agreement will not be obtained such that the transaction will be completed in accordance with its terms or at all, that the Company will not complete the required expenditures and that, as a result, the Bakar Property will be forfeited without any repayment to the Company, negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.